Introduction

When it comes to trading strategies, one often overlooked but powerful tool is divergence. Divergence occurs when the price of an asset moves in the opposite direction of a technical indicator, signaling a potential change in trend. By recognizing and utilizing divergence in your trading strategy, you can gain valuable insights into market dynamics and make more informed trading decisions.

Types of Divergence

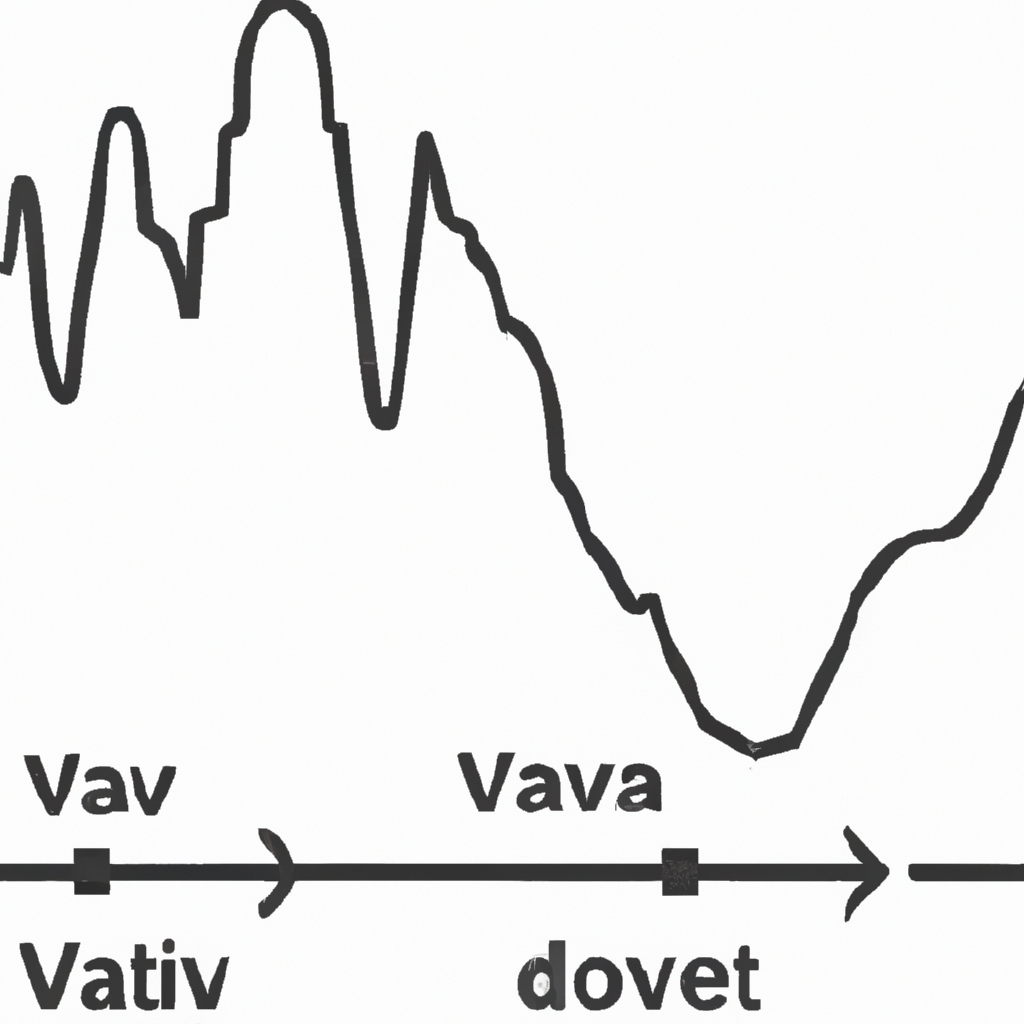

Bullish Divergence

Bullish divergence occurs when the price of an asset makes a lower low, but the corresponding technical indicator makes a higher low. This can indicate that the downtrend is losing momentum and a potential reversal to the upside may be imminent.

Bearish Divergence

Bearish divergence, on the other hand, occurs when the price of an asset makes a higher high, but the technical indicator makes a lower high. This can signal that the uptrend is weakening and a potential reversal to the downside may be on the horizon.

How to Use Divergence in Trading Strategies

Identify Divergence

The first step in using divergence in your trading strategy is to identify it on your charts. Look for instances where the price of an asset and a technical indicator are moving in opposite directions.

Confirm with Other Indicators

While divergence can be a powerful signal on its own, it is always a good idea to confirm it with other technical indicators or chart patterns. This can help reduce false signals and increase the accuracy of your trades.

Set Entry and Exit Points

Once you have identified and confirmed divergence, it is important to set your entry and exit points. Consider using stop-loss orders to limit your losses and take-profit orders to lock in your gains.

Manage Risk

As with any trading strategy, it is crucial to manage your risk when using divergence. Consider using proper position sizing, setting stop-loss orders, and diversifying your trades to protect your capital.

Conclusion

Using divergence in your trading strategies can be a valuable tool for identifying potential trend reversals and making more informed trading decisions. By understanding the different types of divergence, confirming signals with other indicators, and managing risk effectively, you can improve your trading performance and increase your chances of success in the markets.