Understanding Oscillators and Momentum Indicators

Oscillators and momentum indicators are essential tools in technical analysis for traders and investors. They help in identifying overbought or oversold conditions in the market and provide insights into potential trend reversals. Let’s delve deeper into these two types of indicators and understand how they work.

Oscillators

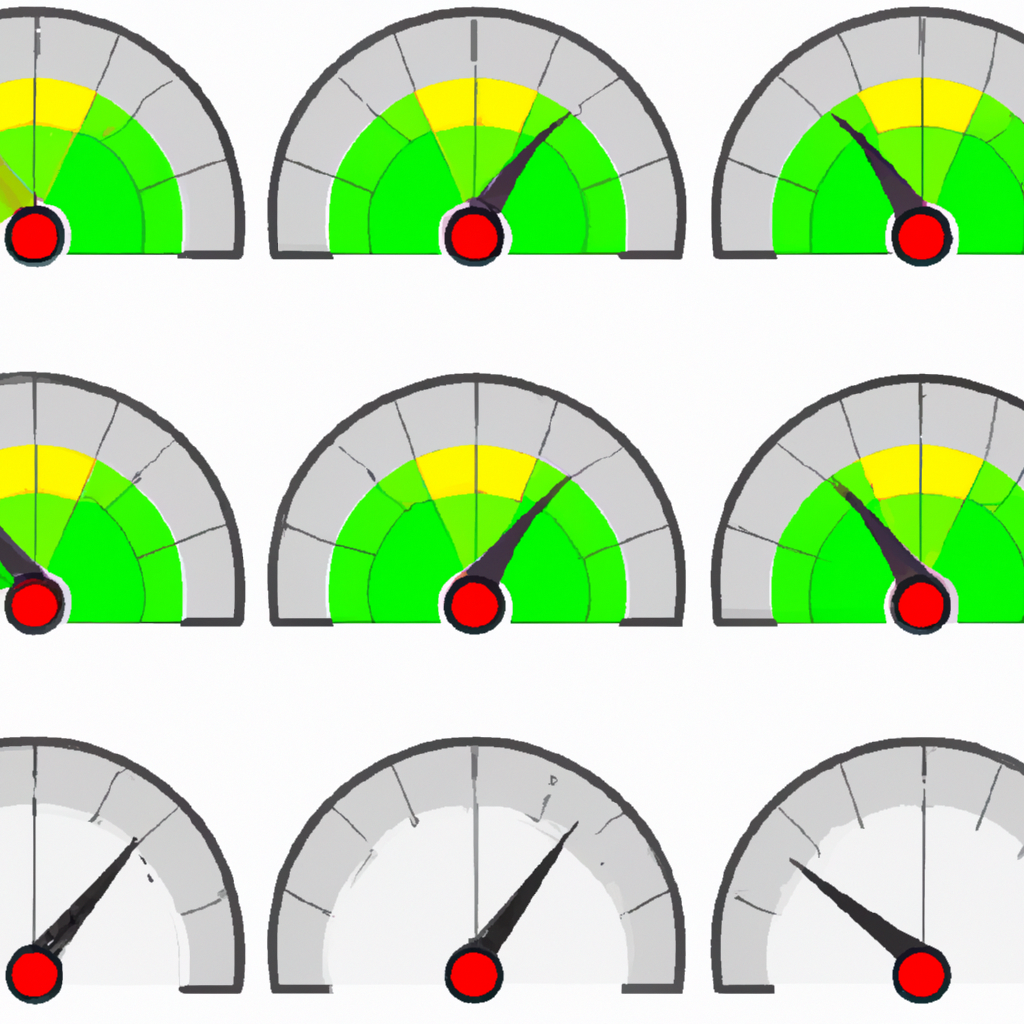

Oscillators are technical indicators that fluctuate within a specific range, typically between 0 and 100. They are used to identify short-term overbought or oversold conditions in the market. When an oscillator reaches extreme levels, it suggests that a price reversal may be imminent.

Some popular oscillators include the Relative Strength Index (RSI), Stochastic Oscillator, and the Commodity Channel Index (CCI). These indicators can be used to confirm price trends, generate buy or sell signals, and identify potential entry and exit points for trades.

Momentum Indicators

Momentum indicators, on the other hand, measure the rate of change in price movements. They help traders gauge the strength of a trend and identify potential trend reversals. Momentum indicators are typically used in conjunction with other technical analysis tools to confirm signals and make informed trading decisions.

Common momentum indicators include the Moving Average Convergence Divergence (MACD), the Average Directional Index (ADX), and the Momentum Indicator. These indicators can be used to determine the strength of a trend, identify overbought or oversold conditions, and generate buy or sell signals.

How to Use Oscillators and Momentum Indicators

- Identify the trend: Before using oscillators and momentum indicators, it’s important to identify the prevailing trend in the market. This will help you determine whether to focus on buying or selling opportunities.

- Look for divergence: Divergence occurs when the price of an asset moves in the opposite direction of the oscillator or momentum indicator. This can signal a potential trend reversal or weakening of the current trend.

- Use overbought and oversold levels: Oscillators often have overbought and oversold levels, typically set at 70 and 30, respectively. When an oscillator reaches these extreme levels, it may indicate a reversal in the price trend.

- Confirm signals: It’s important to use oscillators and momentum indicators in conjunction with other technical analysis tools to confirm signals. This can help reduce false signals and improve the accuracy of your trading decisions.

Overall, oscillators and momentum indicators are valuable tools for traders and investors looking to analyze market trends and make informed trading decisions. By understanding how these indicators work and how to use them effectively, you can improve your trading strategies and increase your chances of success in the market.