Harmonic Patterns in Trading

Introduction

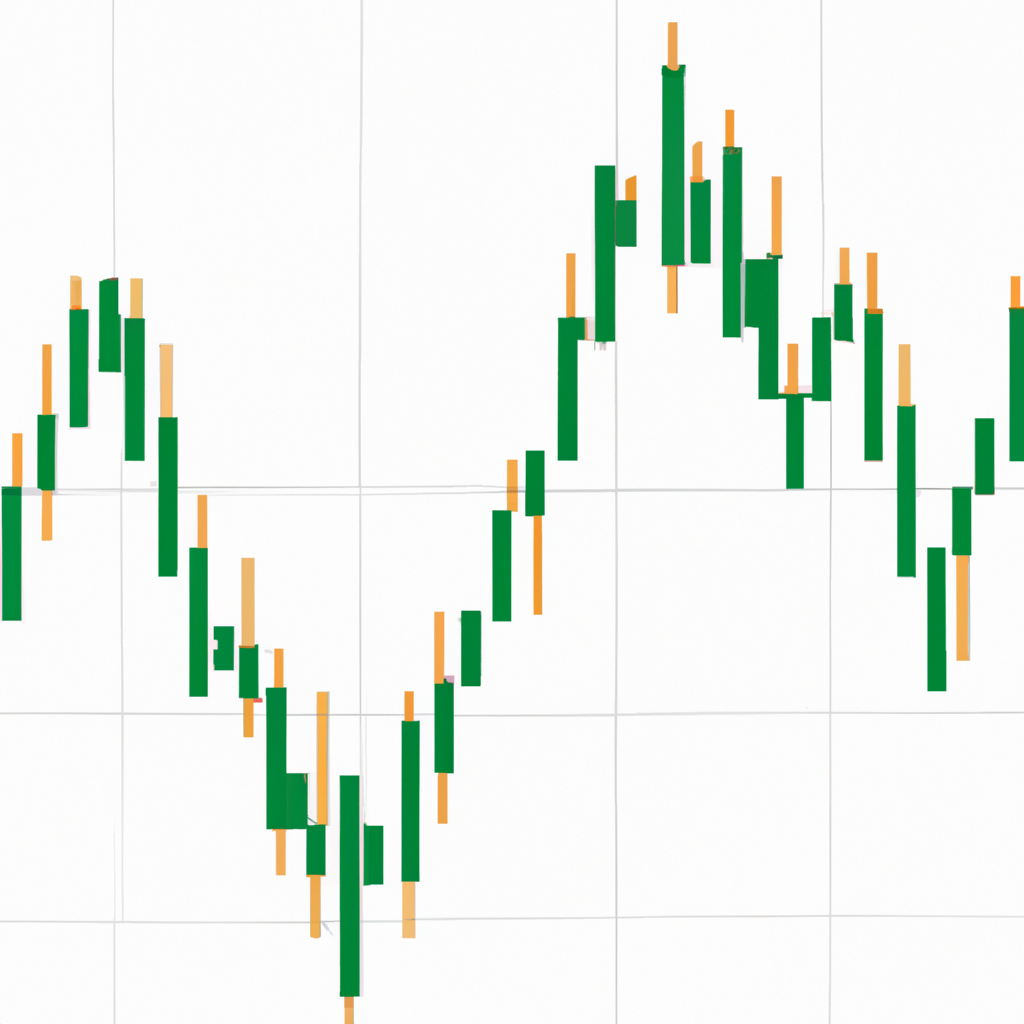

Harmonic patterns are a type of technical analysis that traders use to predict future price movements in the financial markets. These patterns are based on geometric price patterns that repeat themselves over time, and can be used to identify potential entry and exit points for trades.

Types of Harmonic Patterns

Bat Pattern

The bat pattern is a harmonic pattern that consists of four price swings, with the second and third swings forming a retracement of the first swing. Traders look for the completion of the pattern to enter a trade in the direction of the trend.

Butterfly Pattern

The butterfly pattern is similar to the bat pattern, but with different Fibonacci levels for the retracement. Traders use the butterfly pattern to identify potential reversal points in the market.

Gartley Pattern

The Gartley pattern is a harmonic pattern that is formed when the price action creates a series of higher highs and lower lows, followed by a retracement. Traders use the Gartley pattern to enter trades at potential turning points in the market.

How to Trade Harmonic Patterns

Identify the Pattern

The first step in trading harmonic patterns is to identify the pattern on the price chart. This can be done by using Fibonacci retracement levels and looking for specific price swings that match the criteria for the pattern.

Confirm the Pattern

Once the pattern has been identified, traders should look for additional confirmation signals before entering a trade. This can include using other technical indicators or waiting for a specific price action signal to confirm the pattern.

Set Stop Loss and Take Profit Levels

It is important to set stop loss and take profit levels when trading harmonic patterns to manage risk and protect profits. Traders should place their stop loss orders below or above the pattern, depending on the direction of the trade, and set a target price based on the potential price movement of the pattern.

Conclusion

Harmonic patterns are a powerful tool for traders to identify potential entry and exit points in the financial markets. By understanding how to identify and trade these patterns, traders can improve their trading strategy and increase their chances of success.