Introduction to Elliott Wave Forecasting Models

Elliott Wave forecasting models are a popular tool used by traders and analysts to predict future price movements in financial markets. This technical analysis method is based on the theory that market prices move in repetitive patterns, or waves, which can be identified and used to forecast future price movements.

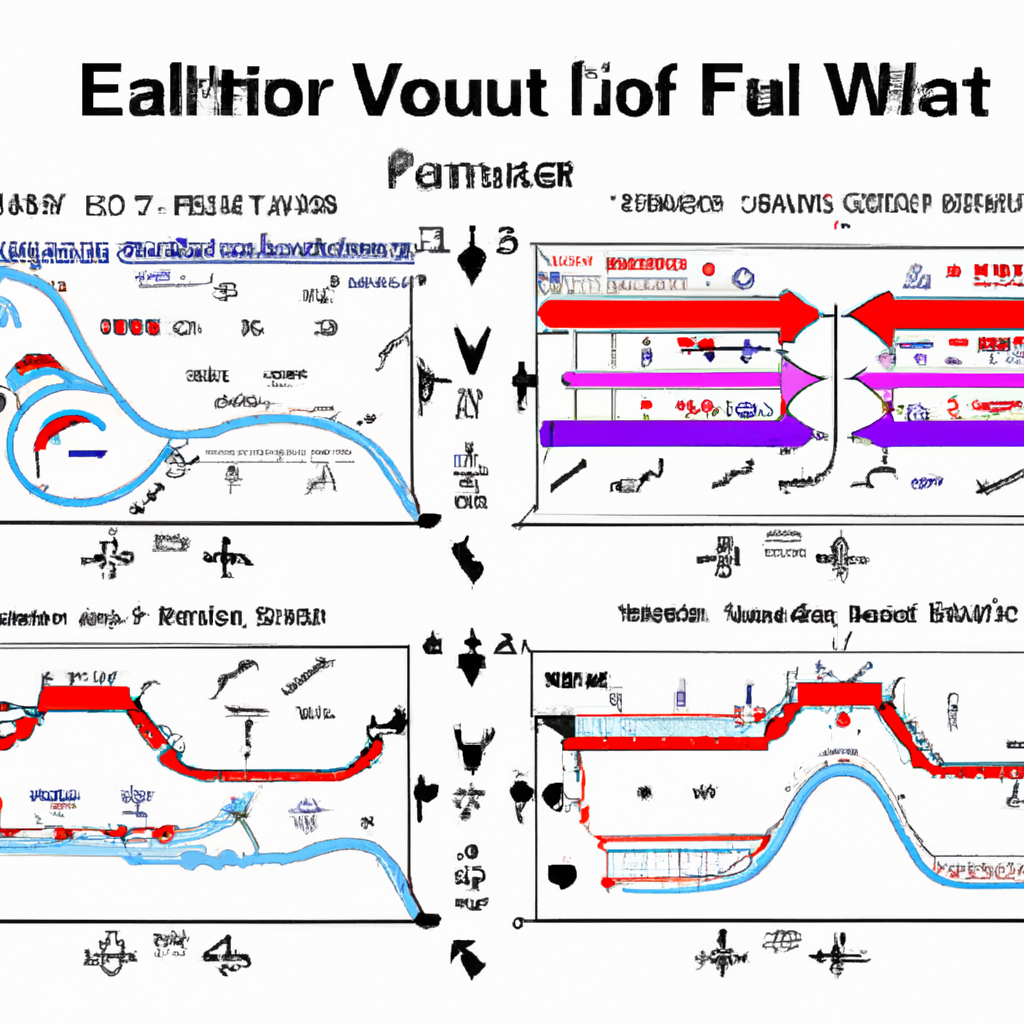

Understanding the Elliott Wave Principle

The Elliott Wave Principle was developed by Ralph Nelson Elliott in the 1930s. According to this theory, market prices move in a series of five waves in the direction of the main trend, followed by three corrective waves. These waves are labeled as impulse waves and corrective waves, respectively.

Key Concepts of Elliott Wave Forecasting

- Impulse Waves: Impulse waves are the main trend waves that move in the direction of the overall market trend. They are labeled as waves 1, 3, and 5 in an uptrend, and waves A, C, and E in a downtrend.

- Corrective Waves: Corrective waves are countertrend waves that move against the main trend. They are labeled as waves 2, 4, and 6 in an uptrend, and waves B, D, and F in a downtrend.

- Wave Relationships: Elliott Wave theory also emphasizes the relationship between different waves, such as the Fibonacci ratios that often appear in wave retracements and extensions.

Applying Elliott Wave Forecasting Models

Traders and analysts use Elliott Wave forecasting models to identify potential entry and exit points in the market. By analyzing the wave patterns and relationships, they can make informed decisions about when to buy or sell a particular asset.

It is important to note that Elliott Wave forecasting is not foolproof and can be subjective, as different analysts may interpret the wave patterns differently. However, many traders find it to be a valuable tool in their technical analysis toolkit.

Conclusion

Elliott Wave forecasting models offer traders and analysts a unique perspective on market movements and can help them make more informed trading decisions. By understanding the key concepts of Elliott Wave theory and applying it to their analysis, traders can potentially improve their trading results and better navigate the complexities of the financial markets.