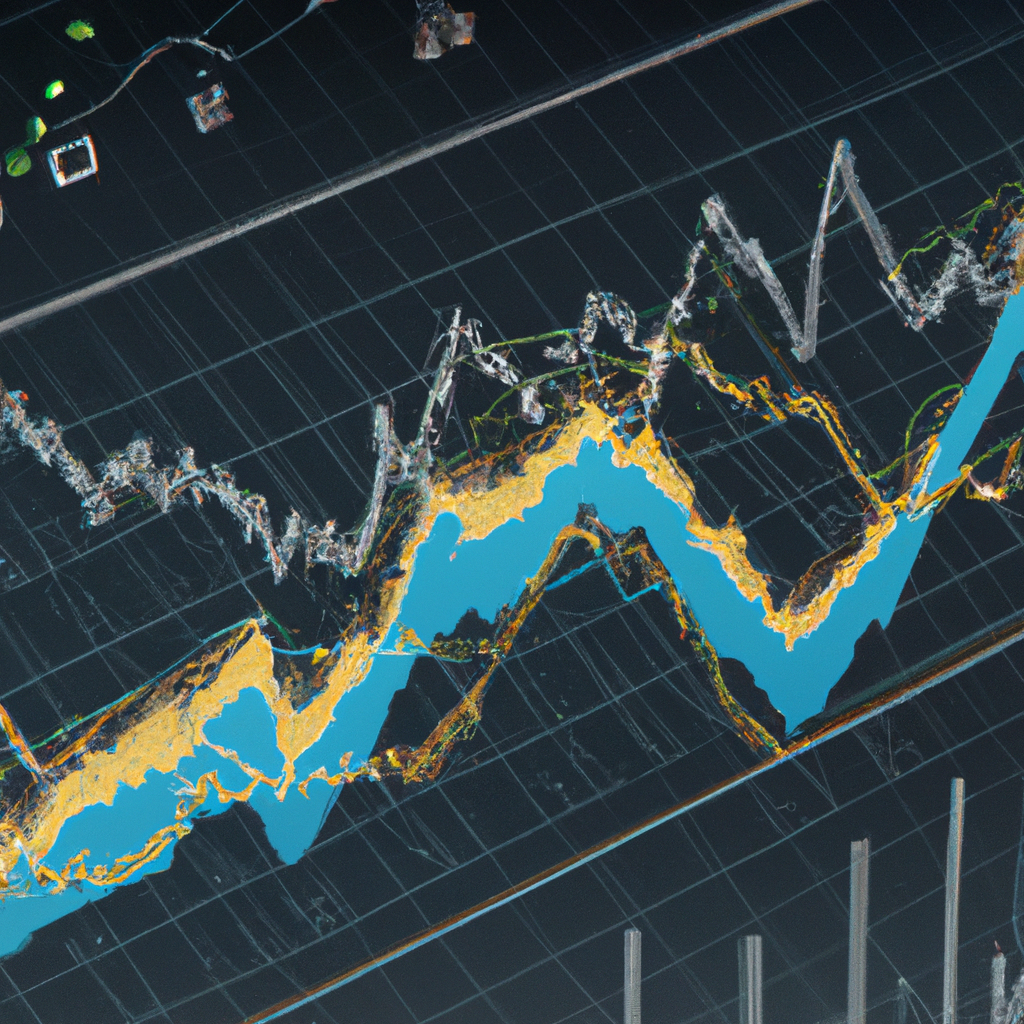

Volume Spikes and Market Reversals

What are Volume Spikes?

Volume spikes refer to sudden and significant increases in trading volume in the stock market. This can be an indication of increased interest and activity in a particular stock or market.

How Do Volume Spikes Impact Market Reversals?

Volume spikes can be a precursor to market reversals, where the direction of a stock or market changes from its current trend. Here’s how volume spikes can impact market reversals:

1. Confirmation of Reversal

Volume spikes can confirm a market reversal by indicating strong buying or selling pressure. If a stock is experiencing a downtrend and suddenly sees a surge in volume, it could be a sign that the trend is about to reverse.

2. Exhaustion of Trend

Volume spikes can also indicate the exhaustion of a trend. If a stock has been trending upwards for a while and then experiences a volume spike, it could mean that the trend is running out of steam and a reversal is imminent.

3. Increased Volatility

Volume spikes can lead to increased volatility in the market, which can create opportunities for traders to profit from market reversals. Traders can use volume spikes as a signal to enter or exit trades based on the potential for a reversal.

How to Use Volume Spikes to Predict Market Reversals

Here are some tips on how to use volume spikes to predict market reversals:

1. Monitor Volume Patterns

Keep an eye on volume patterns in the market and look for sudden spikes in trading volume. Compare the volume spikes to historical data to determine if they are significant enough to indicate a potential reversal.

2. Analyze Price Movements

Pay attention to how price movements correlate with volume spikes. If a stock is experiencing a sharp increase in volume but the price is not moving in the expected direction, it could be a sign of a market reversal.

3. Use Technical Indicators

Combine volume analysis with technical indicators such as moving averages, RSI, and MACD to confirm potential market reversals. Look for divergences between price and volume indicators to identify possible reversal points.

Conclusion

Volume spikes can be valuable indicators of market reversals, providing traders with insights into potential changes in market direction. By monitoring volume patterns, analyzing price movements, and using technical indicators, traders can use volume spikes to predict and capitalize on market reversals.